Gilbert plans to ask voters in November to approve raising a state-spending cap in order to do cash-funded capital projects without being penalized for going over the limit.

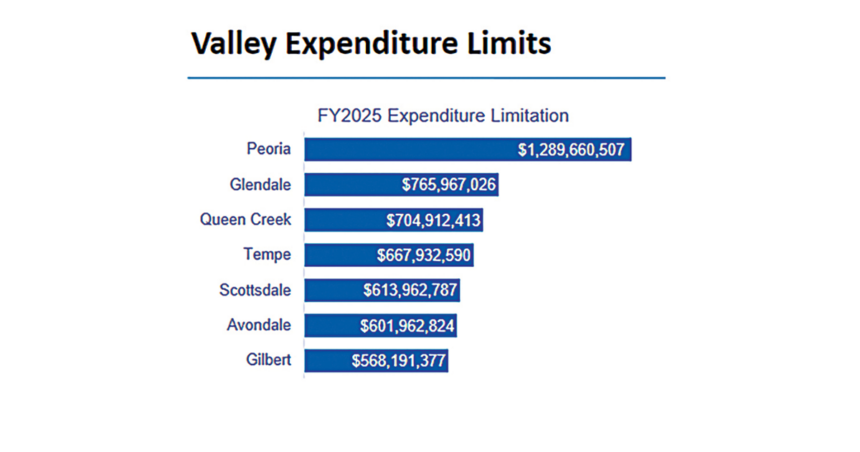

The town’s preliminary spending limit for the fiscal year that begins July 1 is $568 million, which is adjusted for population growth and inflation changes each year. Gilbert’s spending cap in the current fiscal year is $545 million, according to the Economic Estimates Commission, which calculates the limits.

“It has nothing to do with how much funding we have available,” Budget Director Kelly Pfost said at the March 11 council financial retreat. “It’s not just the General Fund but it’s all the town’s expenditures altogether.”

Exclusions under the spending limit include federal grants or aid, revenue from payment of dividends or interest, revenue from the issuance of bonds and bond principal and interest payments.

Pfost said the town has lots of capital projects that are planned in Fiscal Year 2024 and in the future years.

“We have about $370 million in cash-funded capital projects that are in the budget this current year,” she said. “And then we are looking at about $100 (million) to $300 million each year over the next foreseeable future by 10 years.

“So if there gets to be a year when these projects all take construction and really completes there’s a high likelihood we would go over the expenditure limit mostly due to the capital projects.”

According to Pfost, the penalty for overspending is “bad.”

The state treasurer can withhold the town’s share of the state shared income tax and distribute it to other cities and towns instead. Gilbert’s share of that tax for Fiscal Year 2025 is anticipated at about $60 million.

If the town went over its spending by up to 5%, it would see a revenue loss of up to about $28 million, according to Pfost.

Overspending from 5% to 10% would cost Gilbert up to $60 million and going over by 10% would cost the town up to $20 million.

“Morale of the story is if you go over, really go over really or don’t go over at all,” Pfost said facetiously.

She presented five options to increase the spending limit.

Council agreed with Pfost to call for an election May 7 to put the Permanent Base Adjustment and a Capital Projects Accumulation Fund – exempting land and building purchases and improvements from the spending limit – on the November ballot.

Scottsdale also is going to its voters in November for a Permanent Base Adjustment. The city is the only municipality in the Valley with a Capital Projects Accumulation Fund.

Gilbert voters approved a Permanent Base Adjustment for a higher limit in 1998.

Spokeswoman Jennifer Harrison last week said that staff is still working through details of what the Permanent Base Adjustment will be and anticipates having more information available in the coming weeks.

A Permanent Base Adjustment does not raise or impose taxes, and it does not allow the town to spend more than it receives in revenue. The council still needs to adopt a balanced budget.

Under the preliminary cap for Fiscal Year 2025, the per capital spending limit works out to $2,026 per Gilbert resident, the lowest in the Valley.

Pfost pointed out that the town does not spend up to the limit. Using the latest available figures from Fiscal Year 2022, Gilbert actually spent $1,315 per resident, again the lowest in the Valley, she said.

If voters approve the Permanent Base Adjustment, it would go into effect in Fiscal Year 2026, according to Pfost.

“We are getting to the point of potentially going over with all the cash-funded capital projects that we have,” she said. “The longer we wait there is a greater likelihood we will go over and having it in place would be helpful.”

Councilman Chuck Bongiovanni supported moving forward with both proposals and cautioned the importance of educating voters, who he said are likely to view it negatively.

Mayor Brigette Peterson agreed that educating voters was key and noted, “the fact that you are penalized for using cash makes no sense whatsoever.”

Although bonding for projects and paying interest on the debt would reduce the town’s risk of going over the limit, Councilwoman Yung Koprowski said she wanted to avoid that if there is cash available.

And putting both questions on the ballot would minimize the risks “in case voters don’t pass one, they may pass the other,” Koprowski said.

Councilwoman Kathy Tilque said she preferred a Permanent Base Adjustment.

“We did pretty darn good to get us 20 years the last time we did this,” Tilque said. “I hope this is the strategy moving forward, not just a five-year look out.”

She added that she was fine with the Capital Projects Accumulation Fund but worried a bit about having two questions on the ballot.

Other Valley municipalities with a Permanent Base Adjustment include Queen Creek, Tempe, and Peoria. Of the state’s 91 cities and towns, 40 have this in place.

Chandler, Mesa and Phoenix have Home Rule, which set their own spending limit equal to the annual budget. The option requires voter renewal every four years.

Source link

By Cecilia Chan, GSN Managing Editor , www.gilbertsunnews.com

www.gilbertsunnews.com – Vivrr Local Results in news of type article , 2024-03-26 07:00:00

Categories:

Tags: news